The 2009 Bull Market Continues!

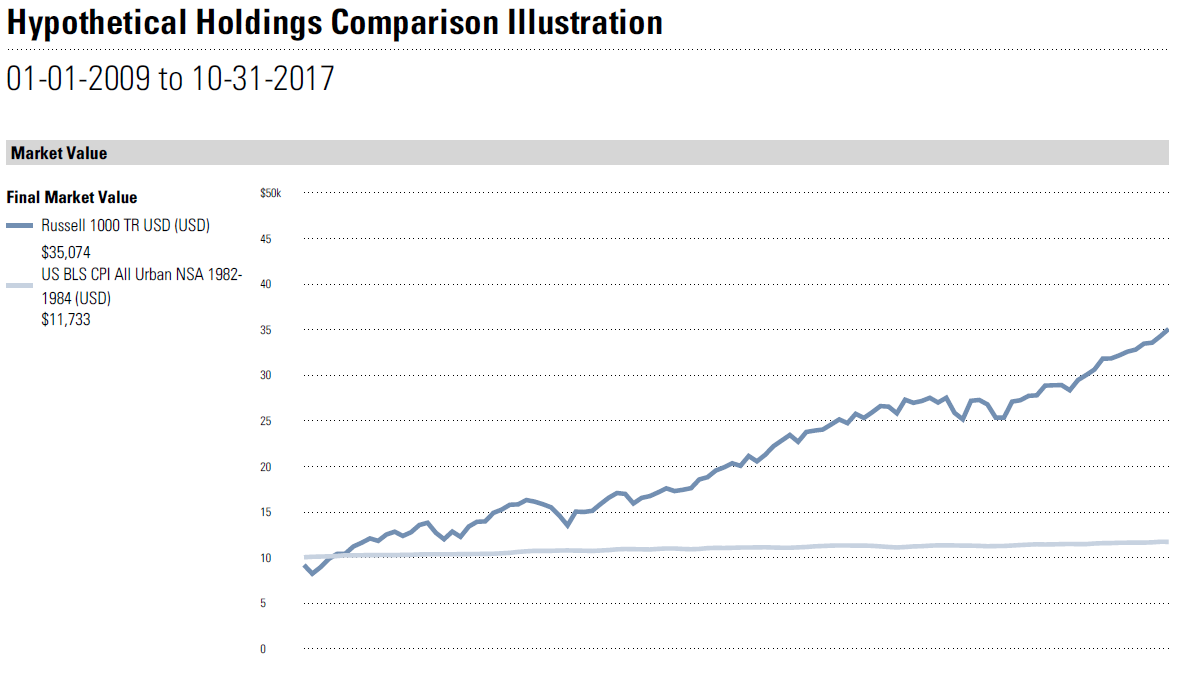

In early 2009, following the 2008 global credit crisis the US stock market began an upward movement which has continued without significant interruption. (See graphic below.) Of course, one question that is on the minds of many investors now is, “Can this continue?” I can answer that question. The answer is, “Yes, it can. But it might not.” 🙂

According to some metrics this bull market should have ended quite a while ago. According to others there is good reason to believe that corporate profits will continue to grow, and stock values will follow. My opinion is that in this rapidly changing world there is plenty of potential for negative events which could reverse the trend, but I will confess that my crystal ball continues to be rather murky.

Our investment clients have participated in the financial benefits of this continuing economic growth. Since January of 2009 the annualized return of our clients’ portfolios has been +6.53%. Inflation during this period has averaged approximately 1.83% per year. Our 6.53% annualized return has been produced by investments in broadly diversified portfolios, which historically have experienced reduced volatility – that is, lower risk. So, when the current bull market ends, we hope to hold on to more of our gains. So far during the 4th quarter of 2017 our investors’ portfolios, in the aggregate have increased in value by 1.85%.

Note: The calculation used to determine our clients’ returns is called the internal rate of return. It is cash flow specific and is net of all fees and expenses. It represents the average return experienced by our investment clients, from the most conservative to the least conservative who were invested during any portion of the period. Typically, our younger clients experience returns greater than the average while our most conservative investors experience results that are lower. Investment return information is provided by Morningstar using GIPS standards.

Financial Planning Associates, Inc. is an investment adviser, registered in the State of Missouri. As such we are required annually to offer to provide a copy of the current version of our adviser’s brochure and privacy policy to our clients. These documents are continuously posted on this website. You can locate them toward the bottom of the front page in the Quick Links area. They are entitled Brochure and Privacy Policy, respectively.

Reverse Mortgage?

Have you seen the commercials on television? You need a reverse mortgage, right? They’re great, right? Well, actually you might, and they might be. During recent years the specifics concerning these financial tools have been improving, and the costs have been reduced.

In doing retirement planning with our clients I do not routinely recommend that reverse mortgages be used to fund retirement income needs. However, I do see this tool as a “fudging” device. That is, if the numbers are just not working out, then a reverse mortgage might help. Given the improvements made in these products recently, I recommend that some of my clients consider their use.

And finally, an important financial definition.

BULL MARKET: A random market movement causing an investor to mistake himself for a financial genius.