“Ladies and gentlemen, this is your captain speaking. We have a small problem. All four engines have stopped. We are doing our damnedest to get them going again. I trust you are not in too much distress.” With these words Captain Eric H. J. Moody “reassured” the passengers on his British Airways Boeing 747 aircraft in June of 1982 as they glided downward in darkness after entering a cloud of volcanic ash. They had been cruising at 37,000 feet when all four engines flamed out. The captain called it a “small problem”. This was an understatement. As I began writing this piece to our clients and friends I initially stated that this is a difficult time. It is. But to call it a difficult time would be an understatement, much like saying that the loss of all four engines on an 800,000 pound aircraft carrying 263 lives is a “small problem”.

Some changes have been made. Increased safety and tax benefits.

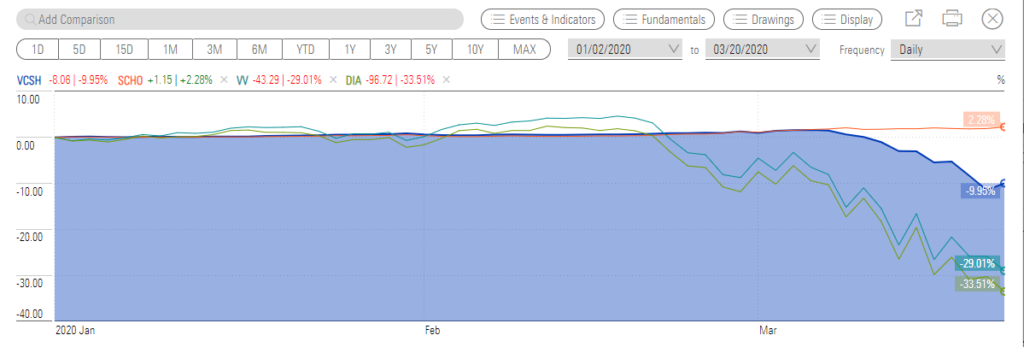

Our investment management clients will have noticed that there has been activity in their accounts of late. In some cases, particularly in the accounts of our more conservative clients we sold positions in the Vanguard Short-Term Corporate Bond ETF (VCSH) and bought shares of the Schwab Short-Term US Treasury ETF (SCHO). The reason for this action is that the Vanguard fund lost value unexpectedly. Apparently the coronavirus pandemic and the resultant “great cessation” caused market forces to question whether holders of short-term investment grade corporate bonds would be getting their principal back. The reason that our clients owned VCSH was to provide a safe yield with little volatility, and during normal times it worked as expected. Then, rather suddenly the times were no longer normal. SCHO holds US Treasury bonds, which cannot default. Our clients will have noticed also that we sold some positions in their taxable accounts. The purpose here was to “harvest” tax losses.

As the graphic below illustrates, from January 1, 2020 to March 20, 2020 US large company stocks (VV) lost 29% of their value, the Dow 30 (DIA) stocks lost 33%, VCSH lost nearly 10%, and SCHO gained 2%. The following week stocks rallied to regain some of the lost value. It is, of course unknown what the coming week(s) will bring.

When will markets recover?

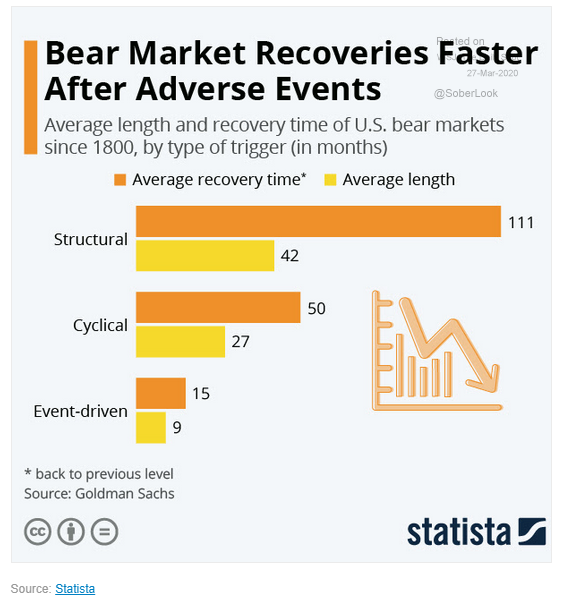

We see from the graphic above that the current bear market has happened quickly. Will the recovery happen quickly as well? No one knows. The graphic below, reproduced from the Wall Street Journal summarizes data concerning bear market recoveries since 1800. According to this summary the average length of an event-driven bear market is 9 months, and the average time to recover to previous levels is 15 months.

The end of the Captain Moody story.

Captain Moody and his crew descended out of the dark cloud at 13,500 feet and were able to restart all four engines and make a safe landing. You can read the story here. Happily, Captain Moody’s small problem did not lead to catastrophe. Our global pandemic has already led to catastrophe for some people, those who have died and/or suffered severe physical illness. More death and suffering is anticipated. And, some have or will suffer economic hardship. We are confident that ultimately this sickness will be behind us, but how long the suffering will last is an unknown.

Our commitment.

We make this commitment to our clients: While we cannot guarantee results, we will do our best to provide services and information to protect your wealth in good times, and especially in bad times.

Your priority.

Be safe. Protect your health.