“…Asset based compensation for psychological counseling…” – Roger Gibson.

It was years ago at a meeting of financial planners that I first met a highly regarded professional in the field by the name of Roger Gibson. At one point, only half joking he said that good investment managers receive asset based compensation for psychological counseling. There is some truth to the statement. For anyone who is interested, one of Roger’s books, Asset Allocation: Balancing Financial Risk is a must read for knowledgeable investors. It has been in my library ever since that first meeting. I have re-read it several times.

So… the values of financial assets change over time, sometimes they go up, sometimes down. And when we encounter a down period it is difficult to remain confident that better times will follow. A look back at prior good and bad times might help us avoid dwelling on the latest drop of the S&P 500 and the latest worry about pandemics or political turmoil.

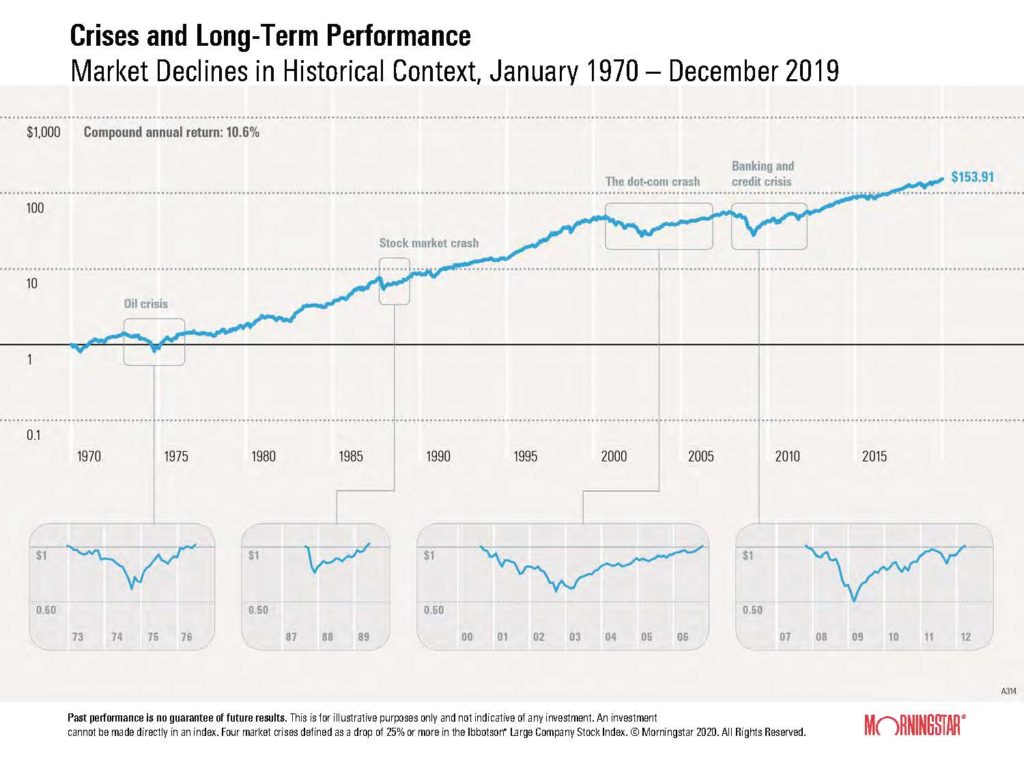

The graphic below is a visual record of the major bear markets experienced by investors in US large company common stocks during the past 50 years. Those of us who were paying attention during these periods remember the uncomfortable feeling. It has been compared to eating a bowl of cold green peas.

Focus on the magnified areas for a moment and imagine how most investors might react to the losses shown. There is, of course a tendency to assume that an astute investor could, and should just bail out of the markets at the start of a downturn and reinvest at the bottom. Much easier said than done. An investor who views the picture and concludes that she could have recognized the turning points in time to profit from them is suffering from a thinking error called hindsight bias. It’s a common affliction.

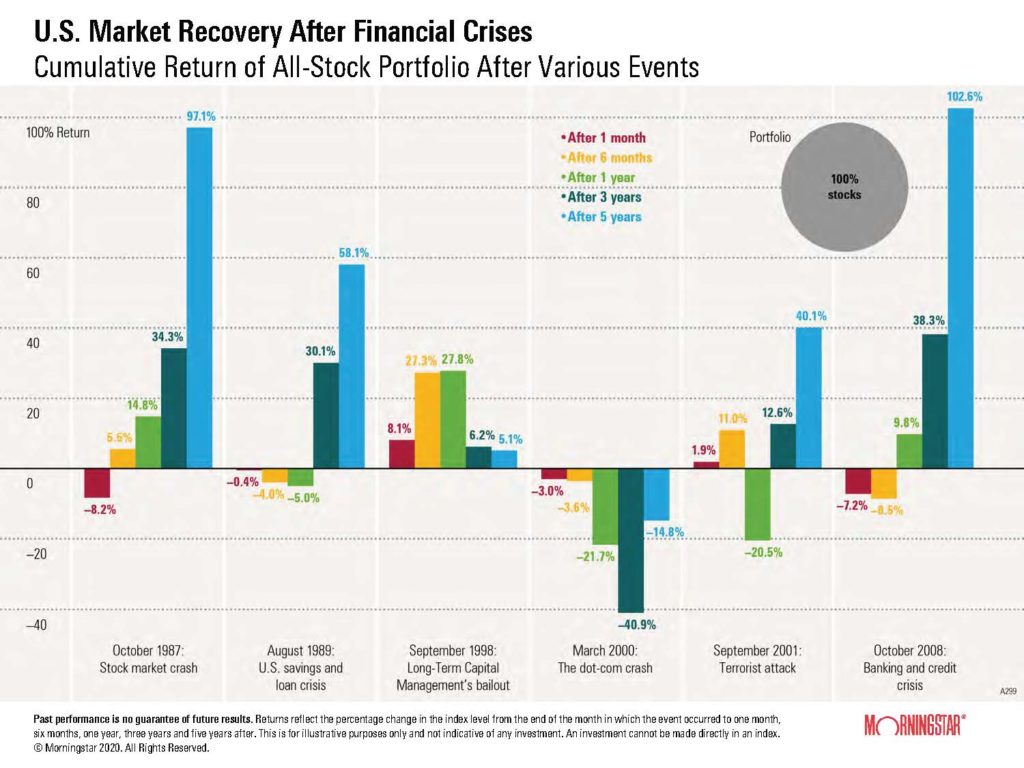

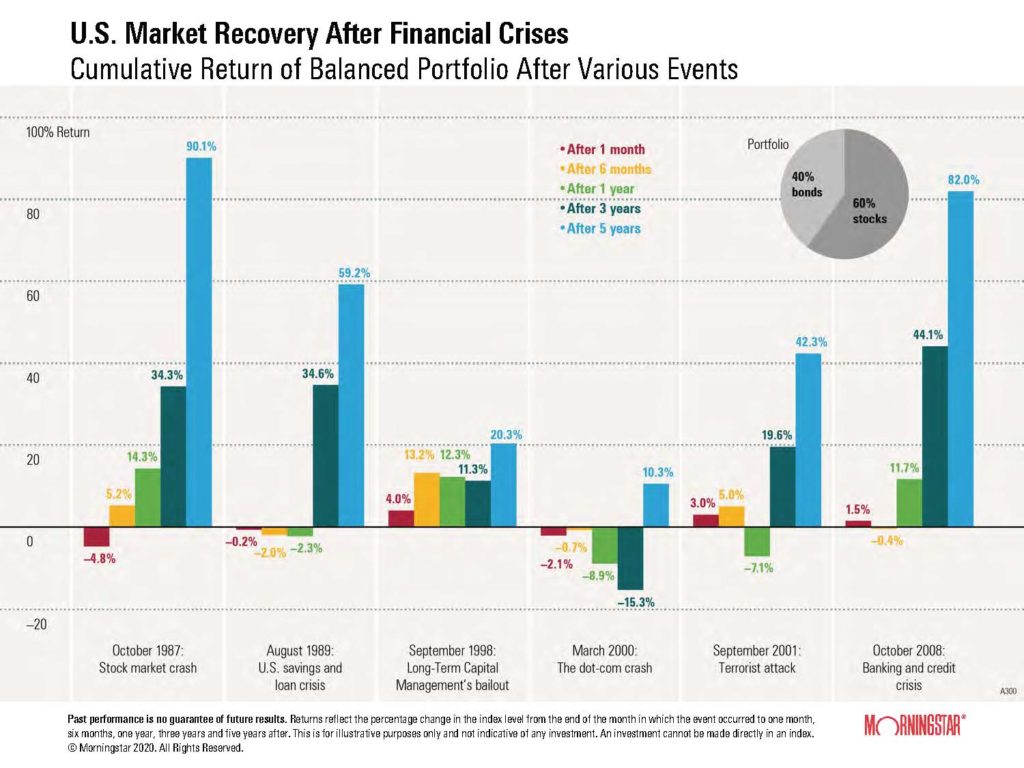

The volatility of financial assets can be mitigated by diversifying among different securities, which may react differently to constantly changing economic conditions. The graphics below illustrate this. Whereas the all-stock portfolio had a -14.8% return during one five-year period, the lowest five-year return experienced by the balanced portfolio during the periods shown was +10.3%. Our clients’ portfolios are balanced. They are also “efficient”, intended to maximize return per unit of risk.

Fortified with the knowledge contained in the above pictures we can stomach a bowl of cold green peas now and then.