Earlier today, June 25 I observed an interview with Jim Bullard, Pres. of the Federal Reserve Bank of St. Louis. Jim is also a voting member of the Federal Open Market Committee (FOMC), the group of (mostly) economists who make policy decisions regarding our central bank. Subsequent to that I observed an interview with the current Fed chairman, Jerome Powell. Both men suggested that continuing low inflation and signs of a slowing economy will likely cause the FOMC to reduce short-term interest rates later this year. Bullard referred to this as taking out some insurance against a severe economic downturn.

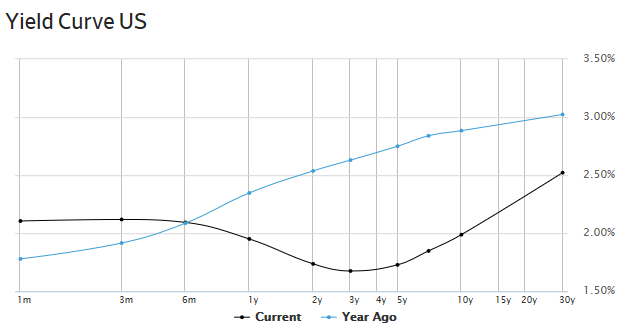

The graphic below illustrates US treasury yields for various maturities as of today (blackline) and one year ago (blueline). A shiny new treasury bond purchased one year ago with a maturity of 30 years would pay an annual interest rate of 3%. Today’s 30 year bond would earn interest of 2 1/2%. As you can see, last year’s investors received higher interest yields if they committed to longer holding periods. Today that is not necessarily the case. The yield on a three-year treasury bond is now lower than the yield on a three-month treasury.

Investors and economists are interested in bond yields, both short-term and longer-term because they provide information useful for developing a portfolio allocation, and possibly anticipating market directions, etc. Generally, longer-term interest rates are higher than shorter-term interest rates. However, this can change. The yield curve can invert, perhaps portending an economic slowdown or recession. You have likely heard opinions lately warning that the shape of the current yield curve bodes ill for investors. This may be true. Or it may not be true.

I have asked financial economist, Thomas Eyssell, PhD., my good friend and frequent mentor to provide some insight for my readers regarding yield curve inversions. His paper can be viewed here. It is well worth the reading time.