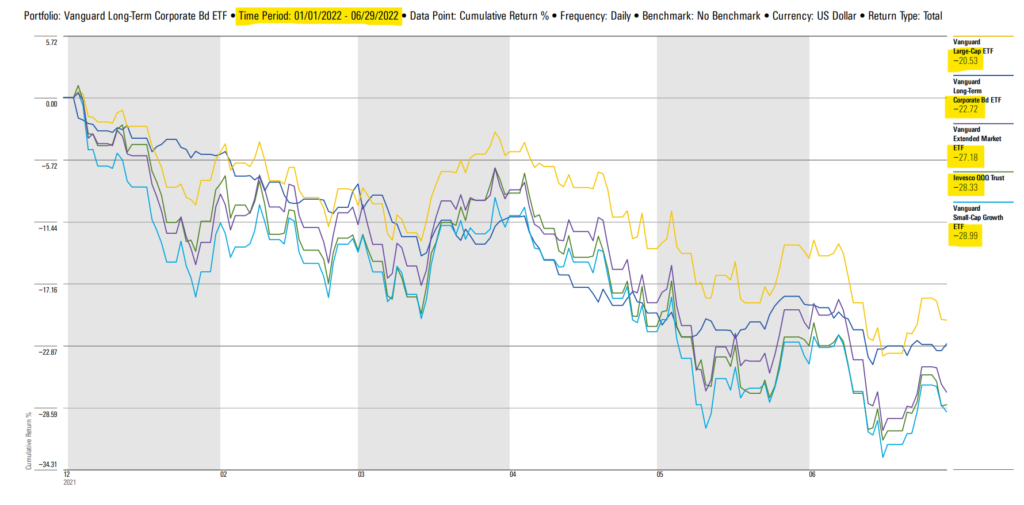

Investors suffered losses during the first half of 2022. The picture below tells the story. Since the downturn has been due primarily to Fed actions intended to abate rising inflation, stocks and bonds have lost value. During the period the Vanguard Long-Term Corporate Bond fund and the Vanguard Large-Cap Stock fund each lost 20% of their value. The stocks of smaller companies and tech sector funds lost nearly 30%.

In a recent email to our investment management clients I offered a more complete discussion of the current investing environment with recommendations for successfully managing periodic losses. A copy of the letter can be seen here.

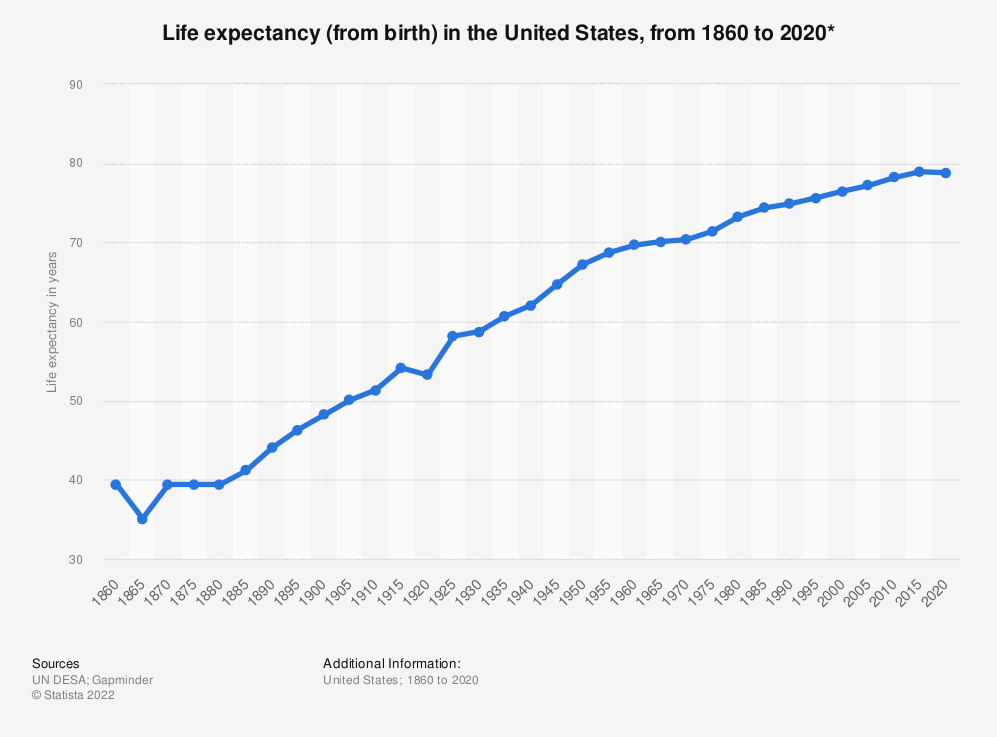

How long will you live? Our financial planning clients have heard me say that I consider it likely that they will live longer than they have imagined. In fact, a few years ago the American Society of Actuaries increased the assumed maximum lifespan of US citizens to age 120, with the result that life insurance costs less today than before. Research produced by the United Nations Department of Economic and Social Affairs and summarized in the image below indicates that life expectancy in the United States has increased from 40 years of age to almost 80 years of age during the period 1860 to 2020.

What does increasing life expectancy have to do with your retirement account? First, it may mean that you have more years to grow your IRA, 401k, etc. Secondly, for those who have not yet reached their Required Beginning Date (RBD) the age has been extended to 72. (Technically, April 1 of the year you reach age 73. Nothing is simple these days.) And thirdly, in consideration of longer lifespans the IRS has now reduced the Required Minimum Distribution (RMD) amounts. Following below are links to two references concerning RMDs. If you have questions perhaps these two references will help:

Our office will be operating in slow motion the week of July 11th, while Jayne and I enjoy some vacation time. During our vacation we will usually be near tablet computers and/or laptop computers, and of course smart phones. So, if you have an urgent need during our vacation time we will do our best to provide urgent service, but if you have a need that is not urgent please send us an email and we will follow up during the following week.