No doubt when your news feeds have not been focused on domestic polemics, Canadian wildfires, unusual flooding, record setting heat, or Taylor Swift’s latest tour you have noticed that artificial intelligence (AI) is getting some attention. Of course, AI has been a discussion topic for decades – I first wrote about it in this blog almost ten years ago – but what had been supposition is now reality. The degree to which the norms of our lives will be disrupted is yet to be determined, but the disruption has begun.

ChatGPT:

One reason for the increased interest in AI is ChatGPT (Chat Generative Pre-Trained Transformer), a chatbot developed by OpenAI and launched on November 30, 2022. The clever programming of ChatGPT allows it to assist humans by conversing in human languages through text or voice interactions. In other words, you can talk to it, and it will reply as a human would, but with more available information at hand and likely more skills. It’s the continuing evolution of Siri or Alexa.

Given that computer programs are already controlling certain powers and functions for humankind it is reasonable that increasing artificial intelligence could create risks (I’m sorry Dave, I’m afraid I can’t do that!). Several months ago, I posed the question, “Is AI dangerous?” to ChatGPT. The software searched the internet for information related to the question and wrote a summary in response, with references to sources and options to dig further if desired. The response is shown below (without the sources, etc.)

More recently, I asked Microsoft’s Bing Chat (which uses OpenAI’s GPT-4) to “draw an image of a Hanna Barbera George Jetson with white goatee in Golden State Warriors cap at a computer.” The software created the image below. It took maybe 10 seconds. By the way, I intend to use this image as an icon representing yours truly. Don’t know just how yet, but that’s the plan.

To add even more excitement to the current interest in AI, consider the burgeoning field of quantum computing. I recently read Michio Kaku’s new book, Quantum Supremacy. The bottom line is that quantum processes and quantum computing have the potential to greatly improve life on Earth, including increasing the capabilities of artificial intelligence.

Just how good was the 1st half?

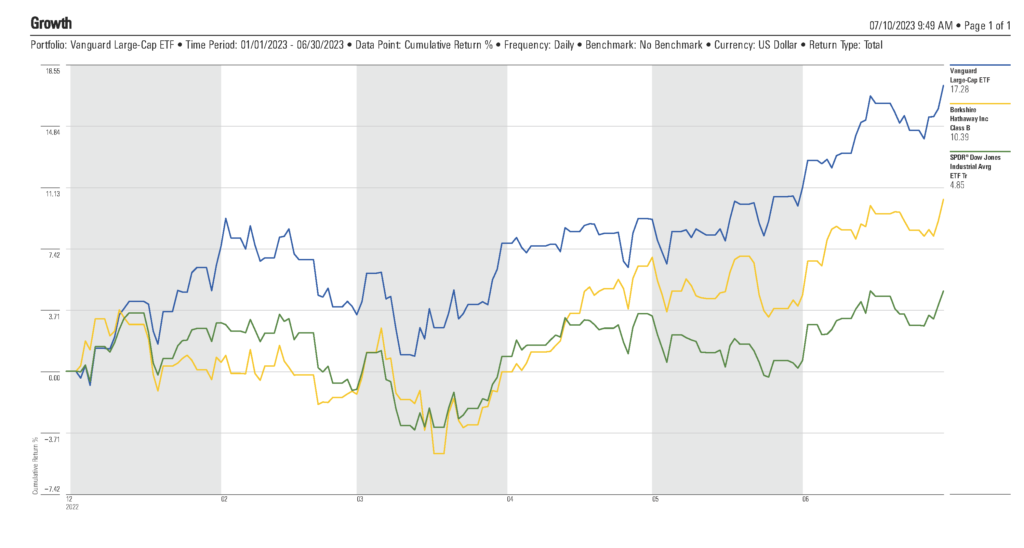

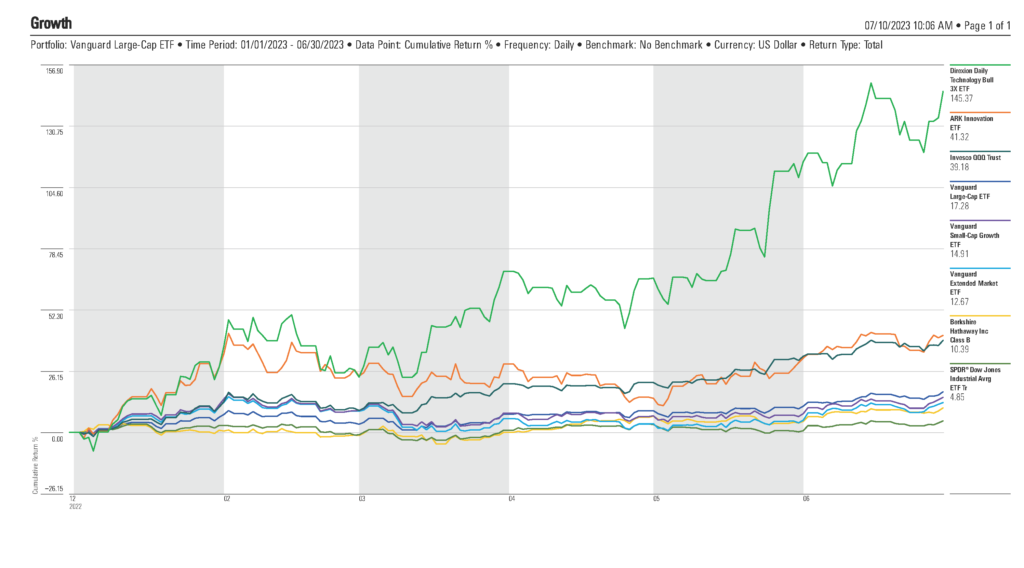

As the image above – created quickly and easily by Bing Chat – indicates, the first six months of 2023 have been very good for our investment clients. As should be expected, during a “good market” our less conservative clients gained more than our more conservative clients. The images below will show the gains through the 1st half of the year for some of the exchange traded funds typically included in our clients’ portfolios.

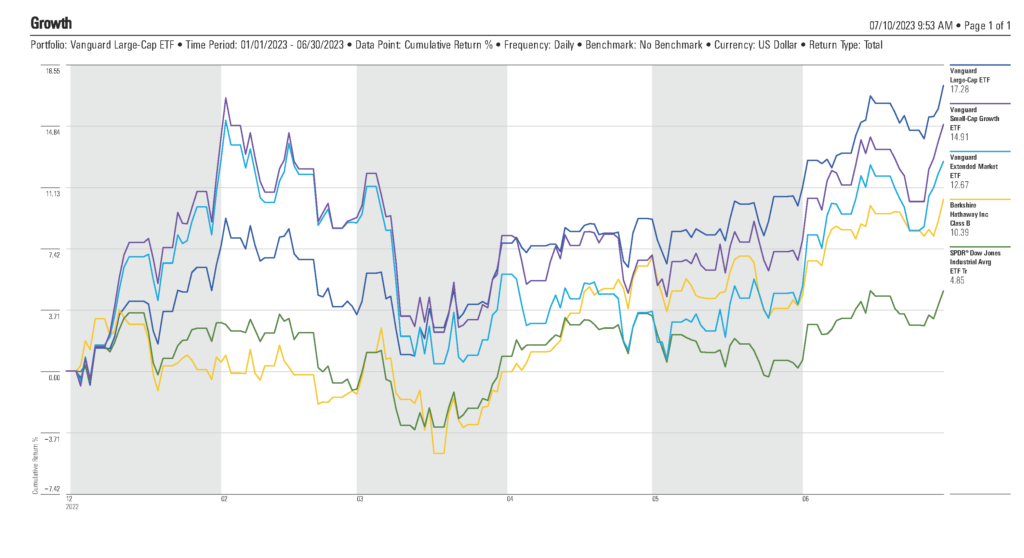

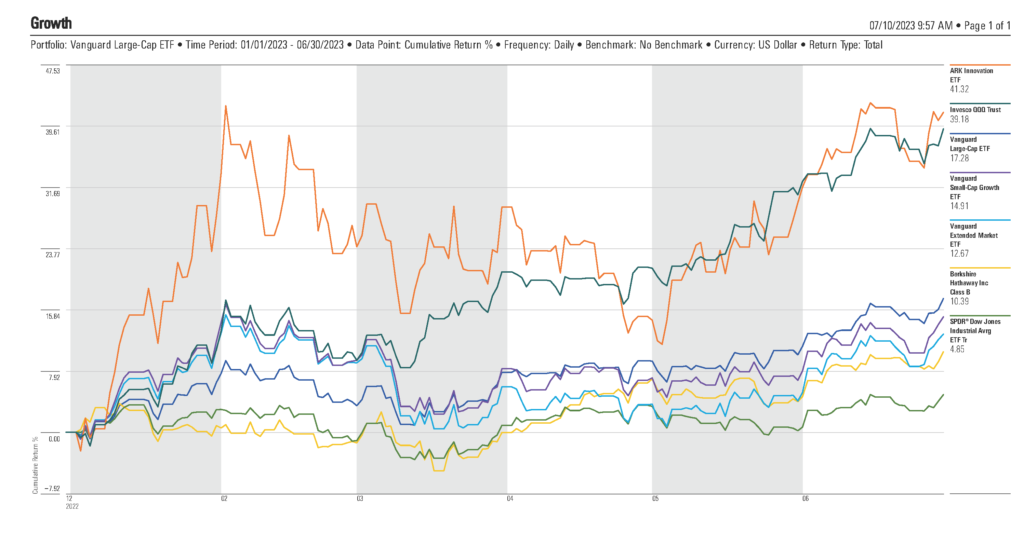

Note: Click on an image below to enlarge it. Click again to enlarge it more. Click your browser back button to return to the blog post.

The Vanguard Large-Cap Index Fund (VV), +17.28%, is the primary equity position held by our clients. Over long periods it tends to track fairly closely to the Dow 30 Industrial Average (DIA), +4.85%, although during this period the Dow trailed VV. Also, some of our client accounts hold a portion of their equities in Warren Buffet’s Berkshire Hathaway stock, (BRK.B), +10.39%.

Many of our client accounts also hold the Vanguard Extended Market ETF (VXF) +12.67%, and the Vanguard Small-Cap Growth ETF (VBK) +14.91%. These funds invest in the common stocks of “smaller” companies, which tend to be more volatile than the stocks of larger companies but may reduce portfolio risk at times.

The Invesco QQQ Trust ETF (QQQ) +39.18%, and the ARK Innovation ETF (ARKK) +41.32% hold the stocks of companies expected to grow rapidly during good times. These funds are not as broadly diversified as the index funds represented in the first two graphics and are therefore likely to be more volatile. Our most conservative clients do not typically hold these funds. Moderate investors may hold a small portion of these, or none. Aggressive investors may hold a greater allocation.

The Direxion Daily Technology Bull 3X ETF (TECL) +145.37% is a leveraged technology sector fund. During bull markets the growth is multiplied, as is the loss during bear markets. It is not recommended for most of our clients.

Please note:

Investment Reports: Clients of Financial Planning Associates, Inc. are able to view their investment information at any time by signing into their secure web portal. Client investment reports include detailed information regarding account holdings, returns, transactions, billings, etc.

FPAI Brochure and Privacy Policy: Links to the current FPAI brochure and Privacy Policy disclosures are continually posted toward the bottom of the www.fpai.net landing page.

A brief note concerning Social Security:

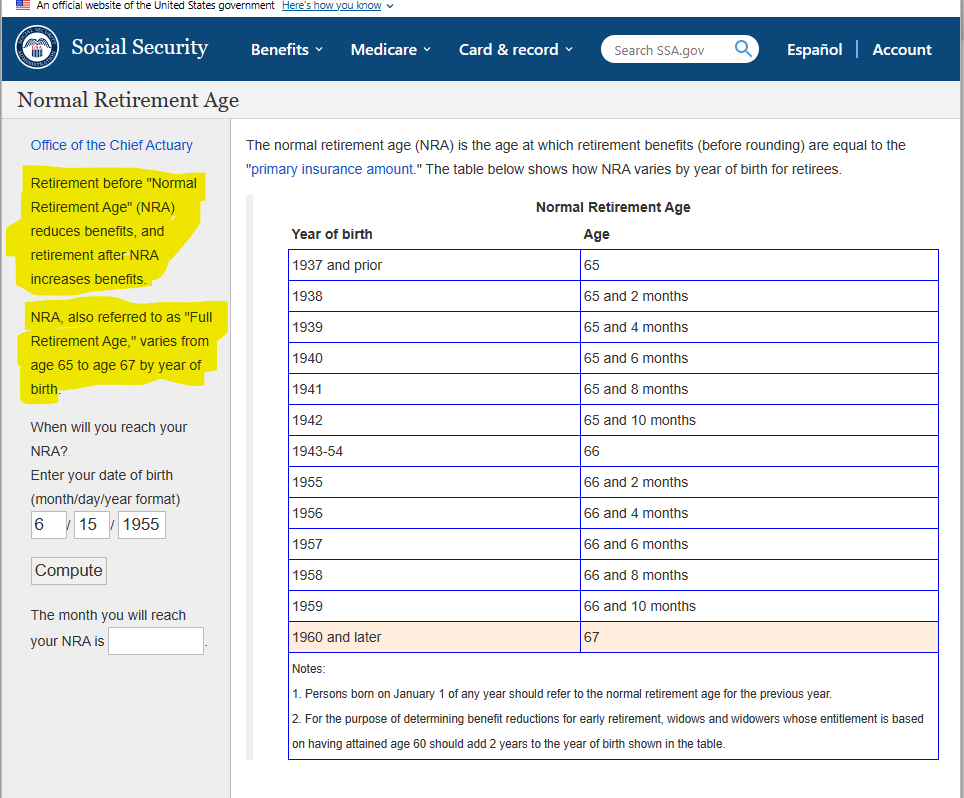

Because there is sometimes confusion about the Social Security “normal retirement age” I include the image below which is from the SSA.GOV website. Please note that normal retirement age (NRA) is the same as the full retirement age (FRA), which varies based on the age of the beneficiary.

Coming attractions:

- About Structured Notes

- The Future of Transportation

- Exploring our RightCapital financial planning tool

Welcome to new readers:

If you are a new reader of our blog, we welcome you. I post to this blog several times a year with information that I think will be of interest to our clients and friends. The format is informal, and you are invited to post a comment if you would like to. You are also invited to review previous postings. You may find useful and/or amusing information.

Regarding the performances images: © 2023 Morningstar. All rights reserved. Use of this content required expert knowledge. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdictions. Past financial performance is no guarantee of future results.

Thanks for reading.