We’re back! Actually, we’ve been here all along. It’s just that I haven’t posted to this blog in a while. Not because there haven’t been things to say, quite the opposite. Much has happened, and there has been much that I have wanted to say. But time for writing has been usurped by more urgent duties.

One such urgent duty has been incorporating the use of our new planning tool, RightCapital (RC). We are quite pleased with this comprehensive personal financial planning application and our clients seem to be as well. I’ve noted a couple of the areas where RC excels below. In future posts I will illustrate others.

Also, in this post I’ll provide some information regarding interest rates. If you had any question whether interest rates were relevant to investment results, consider your experience in 2022 vs. 2023. My opinion is that 2024 results will look more like 2023 than 2022.

In a recent post I said that I would discuss an investment type that most people are not aware of, namely structured products. I have used these types of investment alternatives to good effect for the past 20 years. In the right circumstance a structured note, or indexed CD can add value to a portfolio. See below for details.

About our clients:

The thing that I and my team enjoy the most about our work is the clients that we serve. Over time our client relationships become close, personal. We serve educators, engineers, doctors, lawyers, journalists, nurses, architects, artists, IT professionals, directors, the list is long and varied. Some are younger, some older. Some working, some retired. Each one is important to us. We are thankful for each one.

And speaking of retirement, some of our clients have retired recently. For those clients who retired from full-time work in 2023, congratulations! For those who are retiring in 2024, including one that has just retired, congratulations! You know who you are. 🙂

At the beginning of last year, I made a New Year’s resolution to lose 10 pounds…only 15 more to go!

About our new readers: From time-to-time we receive inquiries from folks who have questions regarding financial matters. Providing information regarding financial matters is what we do. And we do it well. While this blog is primarily for our clients, we include those who have had questions and/or expressed interest in our services. We also include certain friends who practice in related disciplines – attorneys, accountants, etc. If this is the first time you have received our publication, welcome. If you have questions looking for answers, questions about retirement, investing, tax strategies, risk management, etc. you may find some of the answers you seek here. If you do not find the answer you seek in this particular posting, I recommend you read through our previous posts. There is a search window that you can use to find your topic. Just go to our landing page and scroll down until you see search window just above the listing of Recent Posts. Better yet, follow the link below to use our planning tool to get information specific to your situation. Your information will be password protected and secure using bank level encryption.

https://app.rightcapital.com/account/sign-up?referral=xUWfsEwSxiVp09d5stEJhw&type=client

If you have questions concerning the use of our planning application, send me an email with your question(s). Send to carl@fpai.net.

About RightCapital:

For 20 years our office used a financial planning tool called Naviplan that we considered to be the best available. However, in recent years, after being sold to larger companies several times, the Naviplan product has not kept pace with some of its newer competitors. So, we searched for a better alternative and in November of 2022 we began using the RightCapital financial planning application as our primary planning tool. We are extremely happy with the result and anticipate that this will be our planning application from here on. From time to time in this space I will discuss some of the features and benefits of the RC tool.

To begin, the program is not only usable by my office staff, but also operable directly by our clients. For some of our clients this feature is quite desirable. Personal financial planning has always been a partnership between clients and advisors. The ability to be “hands on” can enhance the partnership. In general, we find that younger clients like this feature more than some older clients. It’s all about client preference.

The new application also easily links to financial institutions. As a result, transaction information and values from bank accounts, credit cards, investment accounts, etc. remain current. This feature also allows clients to easily track and organize their incomes and outflows. Knowing the actual value of their expenses and identifying trends becomes much easier. The system uses bank level encryption and multi-factor authentication to maintain data security.

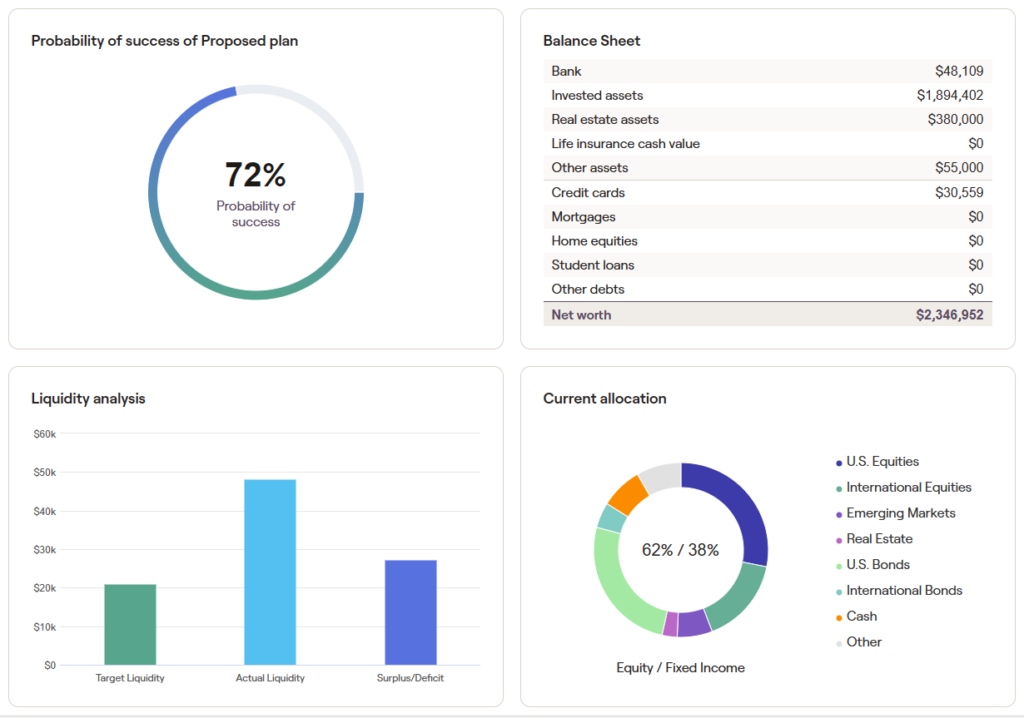

The RightCapital tool easily produces many, many useful reports. Shown below are four basic reports concerning a hypothetical client. The Probability of success of the Proposed plan indicates that there is a 72% probability that the client will reach his/her assumed lifespan without running out of money. This report does not consider real properties, only financial assets. The values of, and effect of real properties, including the effect of reverse mortgages can be considered in different reports. We will discuss the remaining reports, and others in future postings.

The foundation stone of wealth accumulation is defense, and this defense should be anchored by budgeting and planning. – The Millionaire Next Door.

About interest rates:

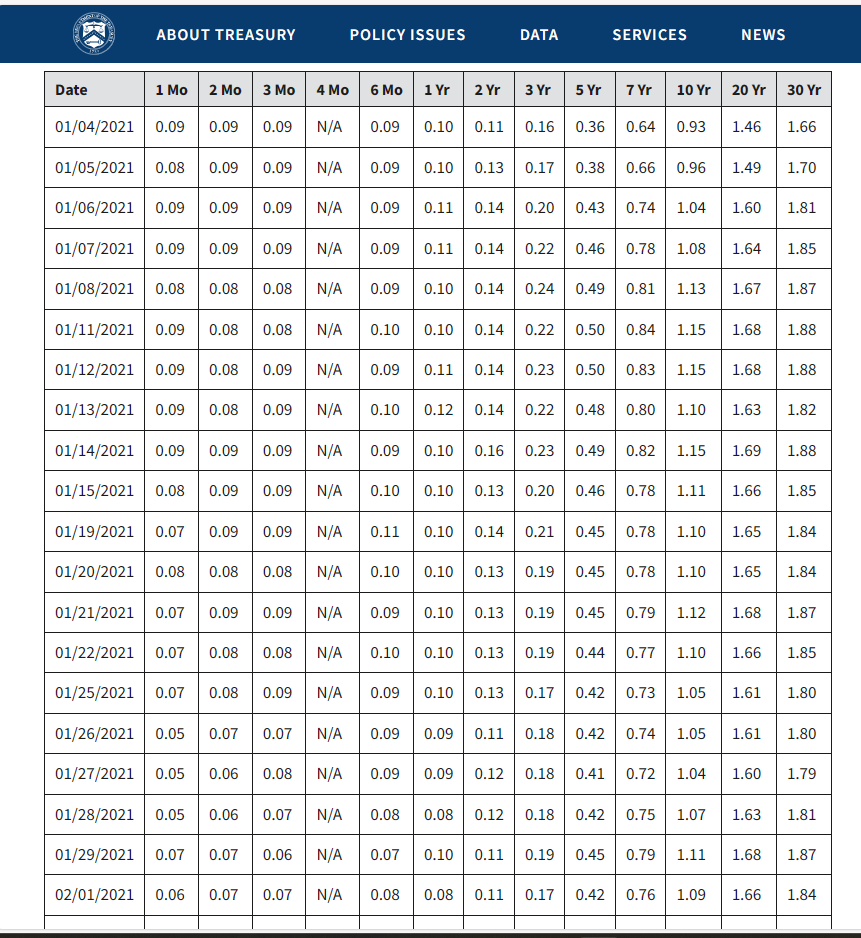

Concern about inflation following the COVID-19 pandemic and the Russian invasion of Ukraine led the Fed to greatly increase interest rates in 2022. For perspective, it is useful to recall the US yield curve as of January 2021. The 3-month Treasury bill rate was about nine basis points, .0009, 9 one-hundredths of 1%. Practically zero. You may recall that Japan and certain European central banks issued negative interest rates. It was an unusual time.

Historically, short-term rates have averaged around the rate of general inflation – 3%-ish. When inflation moves up or down, rates tend to follow. In 2021 if you purchased a 10-year treasury note you would receive annual interest of about 1% (100 basis points). If you committed to 30 years you could get interest approaching 2% per year. In my opinion buying a 30-year bond paying only 2% per year would be a bad idea, but it should also be remembered that for several years the Fed had been wrestling with an inflation rate south of 2%.

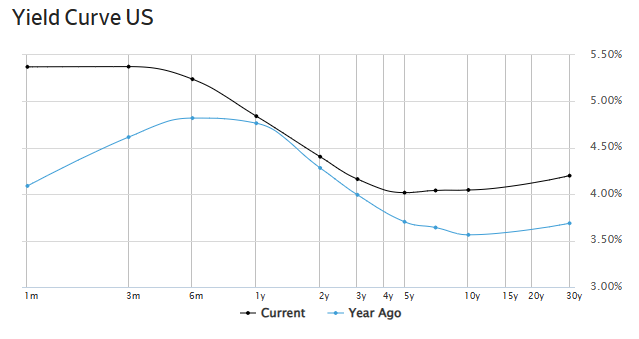

So, as of Monday, January 8th the yield curve, shown below has moved up. Short-term rates are still particularly high. Longer-term rates are closer to historical norms. That the curve has a negative slope between the 3-month holding period and the 5-year holding period is cause for some concern regarding economic growth in the near term. Often this situation precedes an economic recession, though not always.

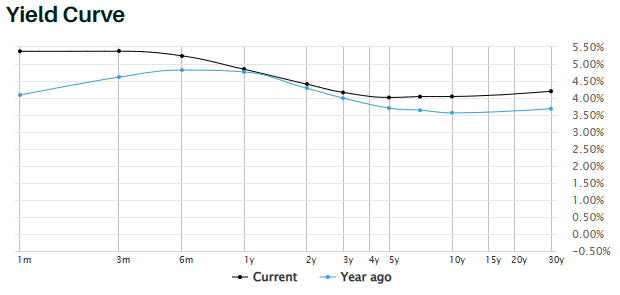

Perhaps the image below provides additional insight regarding the inversion. The curve below is identical to the one above except that the range of the Y-scale is greater, -0.50% to 5.50%. The yield curve sometimes causes investors to be bullish or bearish. These factors among others may result in “good sledding” for stocks and/or bonds in coming months. History would indicate that for long-term investors being bullish usually results in greater gains. As for me, I think inflation is on the run, and that the yield curve will revert to a more normal shape in 2024. If so, our investors are likely to benefit.

Some learned experts, including Professor Jeremy Siegel expect 2024 to be a good year for stock investors. Here is his recent interview on CNBC.

You can’t have everything. Where would you put it? – Steven Wright

About Structured Notes:

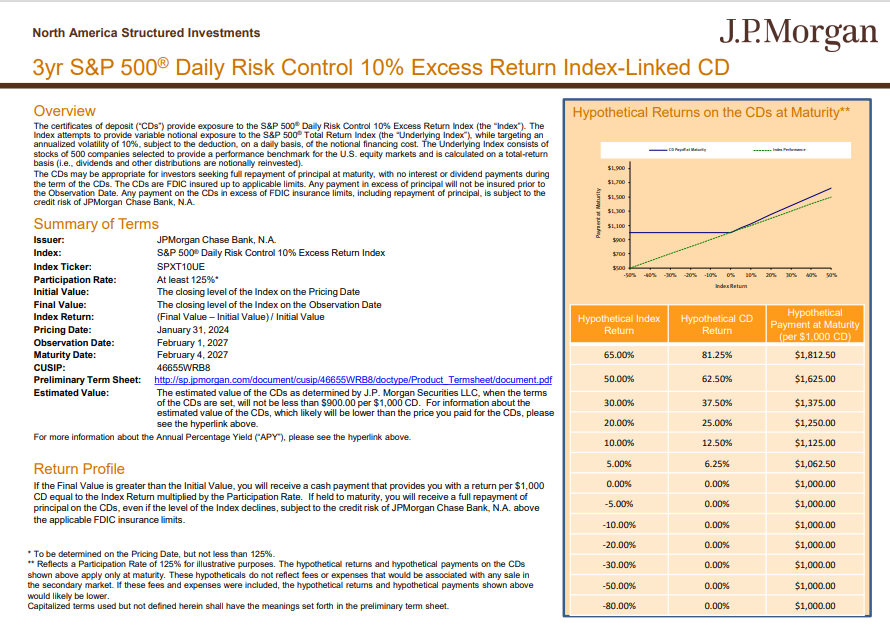

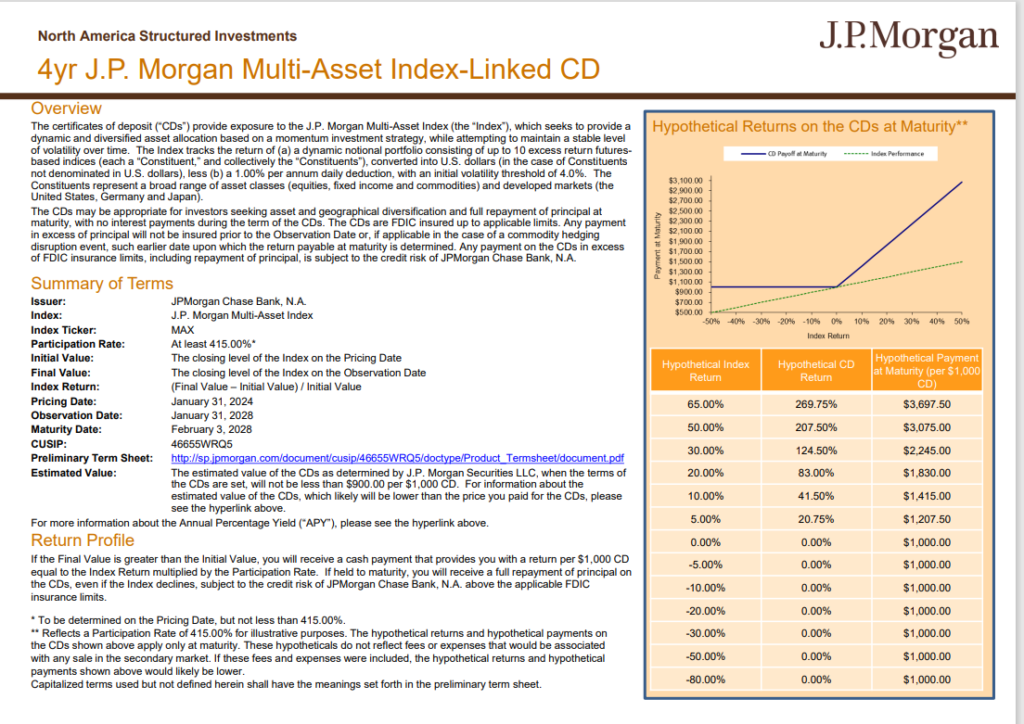

There are times when a structured note can serve a useful purpose as part of a client’s investment portfolio. These securities are issued by banks. In some cases, investment principal is guaranteed by the FDIC as would be the case with a traditional bank certificate. However, instead of interest on the deposit the note offers a final value based on the return of an equity index. The notes are offered monthly with a range of variables regarding risks and returns. Where appropriate we have included these types of investments in our client portfolios since 2003.

Shown below are brief summaries of two current structured note offerings. We do not offer these or any other financial products for sale, nor do we receive any hidden compensation from banks, broker-dealers, insurance companies, etc. We are fee-only financial planners / investment advisors. We are fiduciaries. Where financial product solutions such as structured notes add value in pursuit of meeting our clients’ investment objectives they are included in our fee-only accounts. Prospectuses are available.

About Investments:

After suffering through three frustrating years due primarily to the COVID-19 pandemic and Russia’s invasion of Ukraine, last year we were rewarded for staying the course. On average, our clients’ investments gained 17.14%. Our most aggressive client portfolio was up 52.74%. As should be expected, our more conservative clients experienced lower returns than our less conservative clients, but all had positive returns, with most experiencing double-digit gains. Investment reports for our clients have been posted to their secure web portals.

Note: The calculation used to determine investment returns experienced by our clients is called the internal rate of return. It is cash flow specific and is net of all fees and expenses. Investment return information is provided by Morningstar using GIPS standards.

The question isn’t at what age you want to retire, it’s at what income.

Please note:

Investment Reports: Clients of Financial Planning Associates, Inc. are able to view their investment information at any time by signing into their secure web portal. Client investment reports include detailed information regarding account holdings, returns, transactions, billings, etc.

FPAI Brochure and Privacy Policy: The current FPAI brochure and Privacy Policy disclosures are continually posted toward the bottom of the www.fpai.net landing page.

You take away the looks, money, intelligence, charm and success and, really, there’s no difference between me and George Clooney.

Thanks for reading.