The IRS recently announced adjustments to retirement plan contribution limits. In 2015 the elective deferral limit for 401(k) participants will be increased to $18,000. Most similar plans, 403(b), 457, etc. will allow increased contribution limits as well.

The catch-up contribution limit for employees age 50 and over will increase to $6,000. Therefore, older employees can defer as much as $24,000 next year.

The limit on annual contributions to an Individual Retirement Arrangement (IRA) remains unchanged at $5,500. The additional catch-up contribution limit for individuals age 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000. So, if you are age 50 or older you can contribute up to $6,500 to your IRA in 2015.

For additional information regarding phase-out limits, 415 limits, etc. click here.

What is a QLAC? A qualified longevity annuity contract is designed to be used in retirement accounts. The IRS recently issued final regulations concerning this type of annuity. The idea is to own this contract inside your retirement account so that you will not outlive your income. The contract does not require that you annuitize before your age of 85 and the IRS regulations allow that your required minimum distribution calculation need not count the value of the premium paid for this asset.

Is it a good idea? The intent seems logical enough, to guarantee a lifetime income beginning as late as age 85. In certain circumstances it might be a good idea, but my immediate response is that my client would be better off without it. There are several reasons for my bias against this idea. Firstly, I tend to fear the lack of flexibility with regard to annuitization. That is, once you commit to this plan you have no opportunity to change it. For instance, if your annuitized income is $500 per month and you live longer than expected your purchase power may become significantly eroded, and you will have no opportunity to adjust for this. In general, over long periods I am more concerned with purchase power risk than market risk.

I have other concerns which I will discuss at a later time. For now, this is a rather new idea which should be considered in each individual case to determine its merits. To date, most insurance companies haven’t even offered a QLAC product for consideration. As they do I will re-visit this type of product and post my findings.

Last week we had an interesting experience. It was a fraudulent experience. My office received an email, ostensibly from one of our clients requesting that we send a wire transfer in the amount of $26,000 from his account. Wire transfers, while not everyday events for us are not altogether uncommon. In fact, we have done wire transfers for this client before. However, this type of request warrants a phone call, so I called the client to confirm the details. His response was that he had not sent the email.

We then contacted the fraud department of the bank to which the funds were to have been wired and the local police department. The bank confirmed that the routing and account numbers were correct for one of their account holders. Upon contacting their account holder they were told that he had a romantic relationship with someone online who was to be getting some money, but that the romantic partner would need for the account holder to receive it for “her.” (With regard to this matter we cannot be sure of the identity of the romantic partner, or that she was female.)

So, apparently someone with fraudulent intent hacked into my client’s email account, sending the wire transfer request to my office. And apparently our client and the bank account holder were to have been victims. Fortunately, the scam did not succeed this time.

We have been told by Schwab’s fraud department that this type of scam is quite popular these days. And the bank tells us that a popular variation on this theme is the “online employment” scam. In this case, the perpetrator “hires” someone online to distribute payroll to supposed employees. The perpetrator then hacks a victim’s email account requesting a wire transfer from his financial institution to the “employee’s” bank account. The newly employed paymaster then forwards funds to the supposed employees of the company, perhaps retaining some as his payment.

With regard to internet transactions we are living in a time not unlike the wild, wild west. Beware.

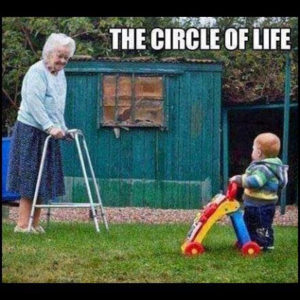

My financial planning clients know that I am optimistic about the future. I believe that our future holds the potential to be better than ever, with more people enjoying longer lives of higher quality. But in the meantime we face problems associated with increasing longevity. In many cases the quality of life is not keeping up with the quantity. My daughter, Hope studied gerontology in college, and is presently employed by an assisted living facility to engage elderly residents for the purpose of deterring mental decline. She and I were talking about her work recently, observing that as we age we sometimes become more childlike. Hope pointed out that she often feels like an elementary school teacher as she directs her residents in certain simple tasks. And, she reports their progress to their children. Much as the elementary school teachers of the children once reported to her residents.

Asset management clients please note that your final 3rd quarter reports, which include consumer price index information were posted last week in your secure electronic folders.