In 2022 some investors are feeling the same way customers of the Bailey Building and Loan felt in 1930, fearing that their assets will soon be worthless. Potter will give them “fifty cents on the dollar” so they must decide whether to take Potter’s offer or ride out the storm. Of course, there are times when cutting one’s losses is the best course, but investors are often rewarded for keeping the faith, adhering to a good strategy during a bad time. In this writing I will provide information helpful for deciding which course to take. For starters, an investor should determine her risk tolerance.

What is risk tolerance?

As we have discussed in a previous blog post, financial advisers consider three components of risk tolerance – risk capacity, risk perception, and risk attitude or tolerance. Of these three components risk capacity is most significant.

Risk capacity: An investor’s risk capacity should be the primary factor considered in the development of an investment strategy or policy. The risk capacity question considers the cost of missed opportunities versus risk of ruin. That is, under the assumption that greater short-term volatility could result in greater long-term gain, at what point would short-term loss jeopardize the overall plan? During our clients’ annual financial planning process reviews they see a comprehensive picture of present and future cash flows, net worth, risks, etc. under various possible scenarios. Their pictures of possible futures provide the needed information to determine their risk capacity. Understanding the information provided by these analyses allows them to have more confidence in their investment plan during difficult times.

Risk perception: The risk perception question has to do with understanding the level and quality of investment experience the investor has. Asset values go up. Asset values go down. Yet no investor has had every possible investment experience, so everyone’s investment knowledge is incomplete. Those of us who have studied capital markets for many years and from many perspectives likely have a less incomplete database of knowledge and insights than other professionals who have committed their careers to studying other matters. Therefore, during difficult times the background and experiences of a seasoned investment adviser can help investors avoid costly mistakes. The adviser will seek to understand the risk perception of his client and to begin a dialogue to understand the client’s risk attitude or tolerance.

Risk attitude/tolerance: In the investment world it is generally true that greater return requires greater risk. Some folks welcome that risk. Others not so much.

Of course, we must recognize that there are several types of risks. Market risk is what most people think of when considering investment risk, because sometimes investments lose value. However, in most cases purchase power risk must be considered as well. This risk is incremental and long-term planning objectives will suffer if it is not recognized and managed. The problem is that those investment types that do a good job of managing market risk do a poor job of managing purchase power risk. And so, investors look for a reasonably comfortable middle ground. That comfortable middle ground is more easily found if the investor’s risk capacity, and risk perception have been identified.

And now for a case study: Let’s consider the Russell 2000 index of US smaller company stocks. This pool of equities represents approximately 2000 of the US-based companies whose market capitalizations are not sizeable enough to qualify to be included in the Russell 1000 index. It includes companies like AMC Entertainment, Avis Budget Group and Macy’s.

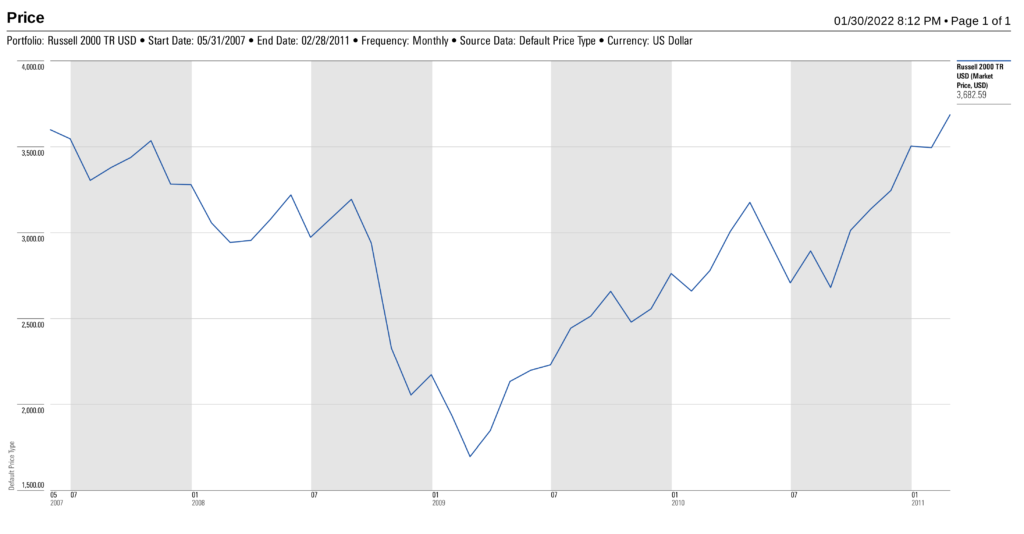

As illustrated in the graphic below investors in the Russell 2000 companies saw the value of their holdings fall by 57% from May of 2007 to March of 2009. I’m sure some investors sold their holdings around March of 2009. Those investors got the Potter deal, “fifty cents on the dollar.” Those who did not sell saw their stocks regain their value by February of 2011.

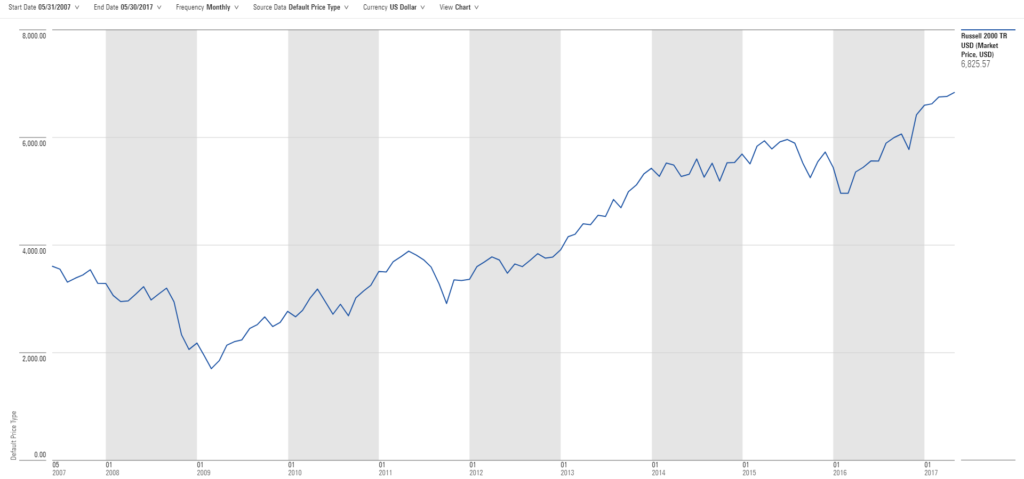

Investors who continued to hold the US small stocks continued to benefit. The graphic below shows the growth of the Russell 2000 companies during the 10-year period beginning on the same date as the previous graphic, May of 2007. By May of 2017, even after having lost 50% during the first two years the investor’s holding was worth 87% more than his original investment.

In the final graphic we see that as of the end of 2021 the value of the Russell 2000 has more than tripled since May of 2007. Those investors with a good plan that included an allocation to US small caps who stayed invested during the downturn experienced good growth over the longer term.

A final thought: One reason that I have chosen the Russell 2000 index to illustrate my point is that smaller companies tend to be more volatile than larger companies, and in the aggregate the stocks of those same companies have gained more than the stocks of larger companies. One holding that many of our clients have which has lost value recently is the Ark Innovation ETF. This fund consists primarily of stocks of smaller companies, such as those found in the Russell 2000 index. This fund is volatile, but I expect it to shine (again) eventually.

For those reading this who are our clients please know that we have assessed your risk capacity, perception and attitude and have recommended holdings that are appropriate considering your objectives and the management of your investment risks. If you are feeling uncomfortable, please let me know. In the meantime, I hope this writing has given you some confidence to stay the course.

You’ll thank me later.

—- Adrian Monk